$72.99 Original price was: $72.99.$56.20Current price is: $56.20.

- No Compromise on Quality

- 7 days free returns

- Multiple payment methods, 100% payment security

- Sustainable materials, for a better tomorrow.

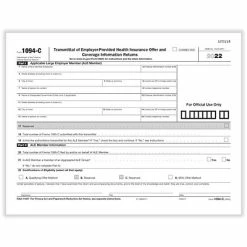

Employers with 50 or more full-time employees (including full-time equivalent employees) in the previous year use forms 1094-C and 1095-C to report the information required under sections 6055 and 6056 about offers of health coverage and enrollment in health coverage for their employees. ComplyRight form 1094-C must be used to report to the IRS summary information for each applicable large employer (ALE) and to transmit forms 1095-C to the IRS. This form is also used in determining whether an ALE member owes a payment under the employer shared responsibility provisions under section 4980H.

-

Form 1094-C must be used to report to the IRS summary information for each applicable large employer (ALE) and to transmit forms 1095-C to the IRS

-

Consists of three parts

-

Laser printer compatible

-

Pack of 500

-

Dimensions: 8.5″ x 11″

| Brand | ComplyRight |

|---|---|

| Customizable | No |

| Length in Inches | 11 |

| Pack Qty | 500 |

| Tax Form Pack Size | 500 |

| Tax Form Type | 1094 |

| True Color | White/Black |

| Width in Inches | 8.5 |

| Year | 2022 |

Be the first to review “Cheap 🔥 Tax Forms ComplyRight 1094-C Tax Form, 500/Pack (1094CT500) 👏” Cancel reply

Related products

New

1099 Miscellaneous Forms for Laser Printers

New

New

New

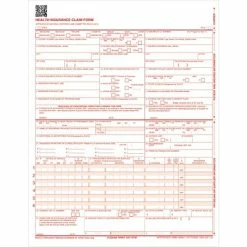

HCFA CMS-1500 Laser Health Insurance Forms

New

New

Business Forms

New

Reviews

There are no reviews yet.