$21.99 Original price was: $21.99.$15.83Current price is: $15.83.

- No Compromise on Quality

- 7 days free returns

- Multiple payment methods, 100% payment security

- Sustainable materials, for a better tomorrow.

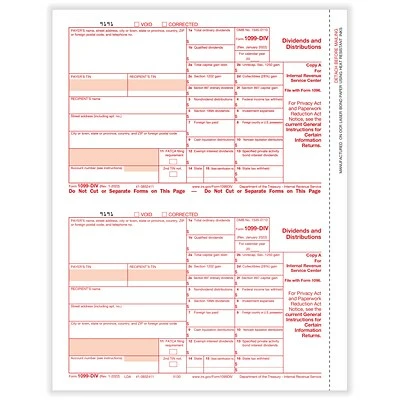

ComplyRight file form 1099-DIV for each person: to whom you have paid dividends (including capital gain dividends and exempt-interest dividends) and other distributions on stock of $10 or more; for whom you have withheld and paid any foreign tax on dividends and other distributions on stock; for whom you have withheld any federal income tax on dividends under the backup withholding rules; or to whom you have paid $600 or more as part of a liquidation.

-

File form 1099-DIV for each person: to whom you have paid dividends and other distributions on stock of $10 or more; or to whom you have paid $600 or more as part of a liquidation

-

2-up: Federal Copy A

-

Compatible with laser printers

-

50 forms per pack

-

Dimensions: 8.5″ x 11″

| Brand | ComplyRight |

|---|---|

| Customizable | No |

| Length in Inches | 11 |

| Pack Qty | 50 |

| Parts | 2 |

| Tax Form Pack Size | 50 |

| Tax Form Type | 1099 |

| Tax Forms Number of Recipient or Employees | 26-50 |

| True Color | White/Red |

| Width in Inches | 8.5 |

| Year | 2022 |

Be the first to review “Best Pirce 💯 Tax Forms ComplyRight 1099-DIV Copy A Tax Form, 50/Pack (513050) ⌛” Cancel reply

Related products

New

Tax Forms

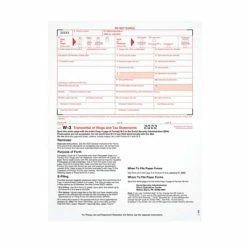

Budget 🌟 Tax Forms TOPS W-3 Transmittal Tax Form, 1 Part, White, 8 1/2″ X 11″, 25 Forms/ Pack 🧨

New

Business Forms

New

Perforated Blank Forms

New

Perforated Blank Forms

New

New

New

New

Reviews

There are no reviews yet.