$21.99 Original price was: $21.99.$15.61Current price is: $15.61.

- No Compromise on Quality

- 7 days free returns

- Multiple payment methods, 100% payment security

- Sustainable materials, for a better tomorrow.

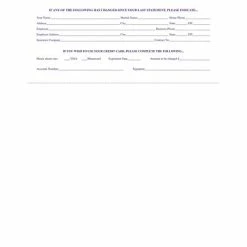

ComplyRight file form 1099-INT, interest income, for each person: to whom you paid amounts of at least $10 (or at least $600 of interest paid in the course of your trade or business); for whom you withheld and paid any foreign tax on interest; or from whom you withheld (and did not refund) any federal income tax under the backup withholding rules regardless of the amount of the payment. Report only interest payments made in the course of your trade or business, including federal, state, and local government agencies and activities deemed nonprofit, or for which you were a nominee/middleman.

-

File form 1099-INT, interest income, for each person: to whom you paid amounts of at least $10 (or at least $600 of interest paid in the course of your trade or business)

-

Single-part, 2-up: Recipient Copy B

-

Compatible with laser printers

-

50 forms per pack

-

Dimensions: 8.5″ x 11″

| Brand | ComplyRight |

|---|---|

| Customizable | No |

| Length in Inches | 11 |

| Pack Qty | 50 |

| Parts | 1 |

| Tax Form Pack Size | 50 |

| Tax Form Type | 1099 |

| Tax Forms Number of Recipient or Employees | 26-50 |

| True Color | White/Black |

| Width in Inches | 8.5 |

| Year | 2022 |

Be the first to review “Best reviews of 👍 Tax Forms ComplyRight 1099-INT 2-Up Recipient Copy B Tax Form, 50/Pack (512150) ❤️” Cancel reply

Related products

New

HCFA CMS-1500 Laser Health Insurance Forms

New

New

New

Tax Forms

Budget 🌟 Tax Forms TOPS W-3 Transmittal Tax Form, 1 Part, White, 8 1/2″ X 11″, 25 Forms/ Pack 🧨

New

New

Business Forms

New

Business Forms

New

Perforated Blank Forms

Reviews

There are no reviews yet.