$11.59 Original price was: $11.59.$8.69Current price is: $8.69.

- No Compromise on Quality

- 7 days free returns

- Multiple payment methods, 100% payment security

- Sustainable materials, for a better tomorrow.

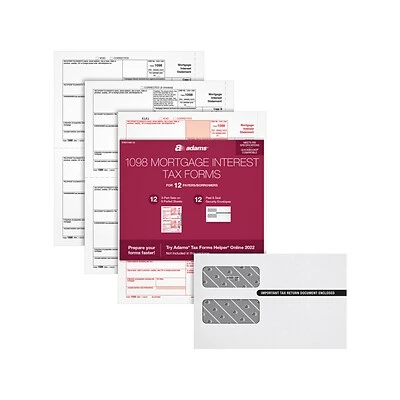

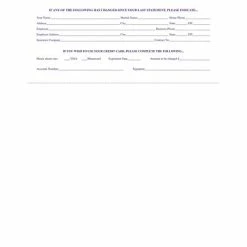

Report mortgage interest, donations on vehicles, interest paid on student loans, and detail tuition fees with the Adams 1098 tax form.

-

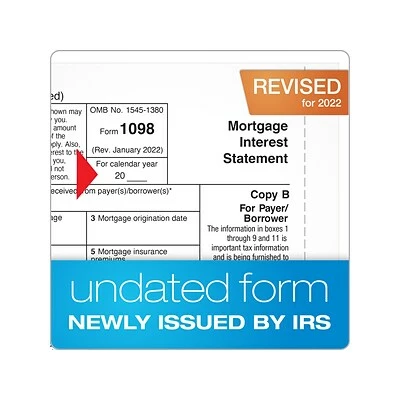

Use form 1098 to report mortgage interest of $600 or more received during the year in the course of trade or business from an individual, including a sole proprietor

-

For paper filers, the 2022 1098 (Copy B) is due to your recipients by January 31, 2023; mail Copy A and the 1096 to the IRS by February 28, 2023 or e-File by March 31, 2023

-

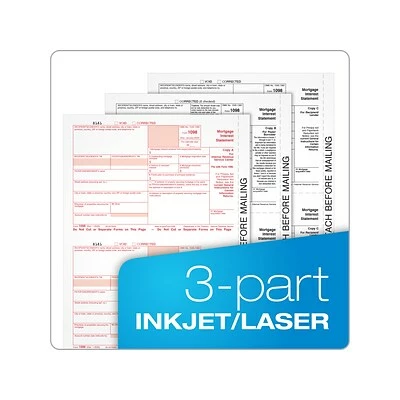

Three-part 1098 forms print two to a page on six microperforated sheets with Copies A, B, and C

-

Inkjet and laser printer compatible

-

Pack contains 12 1098 mortgage interest statements

-

Includes peel-and-seal envelopes

-

Sheet size: 8.5″ x 11″; detached size: 5.5″ x 8.5″

-

White form has scannable red ink required by the IRS for paper filing

-

Acid-free paper and heat-resistant inks produce smudge-free, archival-safe records

-

Compatible with QuickBooks, Adams Tax Forms Helper, and other accounting and tax software programs

-

Meets the IRS standards

| Brand | Adams |

|---|---|

| Customizable | No |

| Length in Inches | 11.25 |

| Pack Qty | 12 |

| Parts | 3 |

| Quick Ship | Yes |

| Tax Form Pack Size | 12 |

| Tax Form Type | 1098 |

| Tax Forms Number of Recipient or Employees | 25-Jan |

| True Color | White |

| Width in Inches | 8.5 |

| Year | 2022 |

Be the first to review “Best reviews of 🧨 W-2 Individual Forms Adams 2022 1098 Tax Form, White, 12/Pack (STAX1098-22) 🔥” Cancel reply

Related products

New

New

Business Forms

New

Perforated Blank Forms

New

Perforated Blank Forms

New

New

Business Forms

New

Reviews

There are no reviews yet.