$11.59 Original price was: $11.59.$8.34Current price is: $8.34.

- No Compromise on Quality

- 7 days free returns

- Multiple payment methods, 100% payment security

- Sustainable materials, for a better tomorrow.

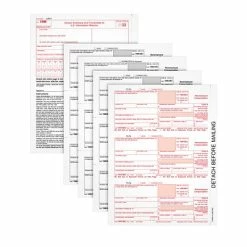

This Adams 1099-INT form makes it easy to report interest income. The Adams 1099-INT form is needed for interest payments of $10 or more.

-

Use the form 1099-INT to report interest income to the IRS and your recipients

-

For paper filers, the 2022 1099-INT (Copy B) is due to your recipients by January 31, 2023; mail Copy A and 1096 to the IRS by February 28, 2023 or e-File by March 31, 2023

-

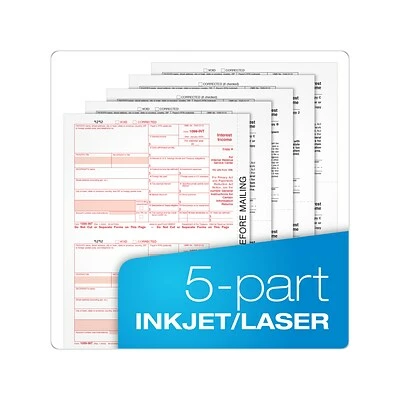

Five-part 1099-INT forms print two to a page on six microperforated sheets with copies A, C/1, B, 2, and C/1

-

Inkjet and laser printer compatible

-

Pack contains 12 1099-INT form sets and 12 peel-and-seal envelopes

-

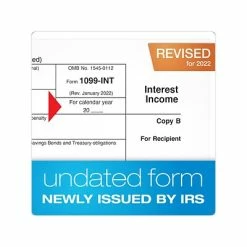

As of 2022, the IRS has made the 1099-INT a continuous-use form with a new fill-in-the-year date field good for multiple tax years

-

Sheet size: 8.5″ x 11″; detached size: 5.5″ x 8.5″

-

White form has a scannable red ink required by the IRS for paper filing

-

Acid-free paper and heat-resistant inks produce smudge-free, archival-safe records

-

Meets or exceeds the IRS standard

-

Online tax software and 1096 summary forms sold separately

-

Compatible with QuickBooks, Adams Tax Forms Helper, and other accounting and tax software programs

| Acid Free | Acid free |

|---|---|

| Brand | Adams |

| Customizable | No |

| Height in Inches | 11 |

| Pack Qty | 12 |

| Parts | 5 |

| Quick Ship | Yes |

| Tax Form Pack Size | 12 |

| Tax Form Type | 1099 |

| Tax Forms Number of Recipient or Employees | 25-Jan |

| True Color | White |

| Width in Inches | 8.5 |

| Year | 2022 |

Be the first to review “Coupon 😍 W-2 Individual Forms Adams 2022 1099-INT Tax Form, White, Dozen (STAX5INT-22) 🎉” Cancel reply

Related products

New

HCFA CMS-1500 Laser Health Insurance Forms

New

New

New

New

New

Reviews

There are no reviews yet.